25+ Mortgage borrowing amount

Use Mortgage Choices borrowing power calculator to work out how much you can borrow for your home loan. Loan term and LVR as input by the useryou.

Fed S Senior Loan Officer Survey Reflects More Normal Economy

Debt is an amount of money borrowed by one party from another.

. 5 year fixed with 75 LTV 25 deposit - 174. Or similar compensation and that is in an amount that is not more than 100000 in 1 year as. Between December 2008 and December 2015 the target rate remained at 000025 the lowest rate in the Federal Reserves history as a reaction to the Financial crisis of.

The last cycle of easing monetary policy through the rate was conducted from September 2007 to December 2008 as the target rate fell from 525 to a range of 000025. Theres not one ideal mortgage rate as it depends on many factors like. Given the amount of fiscal stimulus pumped into the US.

The 36000 isnt the total amount you can borrow. The total amount youll pay back over the initial period takes into account interest capital repayments and lender fees. 5 min read Sep 02 2022 Best bank account bonuses for September 2022.

Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure. Loan repayments are based on the lowest interest rate either standard variable or 3-year fixed rate owner occupier from our lender. Forbearance of residential mortgage loan payments for multifamily properties with federally backed loans.

Contractors Lenders may use an annualised version of your day rate or an average of your net profits depending on the type of contractor you are. Use our suite of popular mortgage home loan calculators to work your borrowing capacity home loan repayments stamp duty savings targets and more. The amount you could borrow may be limited and youll probably need a substantial deposit.

A loan is the act of giving money property or other material goods to another party in exchange for future repayment of the principal amount along with interest or other finance charges. How Much Difference Does 25 Make in a Monthly Mortgage Payment. Do you have a large amount of cash that needs to stay liquid along with a competitive rate.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is secured on the borrowers property through a process. Applicants buy a home with either a smaller deposit or a five-year interest-free government loan to help raise up to a 25 deposit.

Switch to a new lender or. TITLE VI--MISCELLANEOUS PROVISIONS Sec. How much youre borrowing.

If you already have a mortgage youll need to pass this stress test if you. The comparison rate provided is based on a loan amount of 150000 and a term of 25 years. For loans over 144000 we guarantee to your.

321 mortgage possession claims and 255 mortgage possession orders were made every day in England and Wales in January to March 2022. The length of your mortgage term. Use our free mortgage calculator to estimate your monthly mortgage payments.

On 2007 my close friend need amount for his daughters education purposethat time i m helped to him with intrest he is issued promissary notehe is also renwal the same amount on 2010 with in 3 years but that is issue is going on civil court from 2012i m not a money lending business manjust help to friends or closed relatives onlynow he is. Up to 25 premium refund may be available when CMHC Mortgage Loan Insurance is used to finance an Energy-Efficient Home. Fill in some simple details find out today.

In other indications that market demand is falling and people may be focusing on cheaper properties the amount borrowed in mortgages in July came to a total of NIS 101 billion 31 billion. The CMHC Mortgage Loan Insurance premium is calculated as a percentage of the loan and is based on the size of your down payment. Instead it means that if you default on a loan thats under 144000 we guarantee to your lender that well pay them up to 36000.

A credit card on the average interest would take 25 years and 7 months to repay making only the legal minimum repayments each month. Debt is used by many corporations and individuals as a method of making large purchases that they could not afford under normal. The national debt level has been a significant subject of controversy for US.

SoFi rate ranges are current as of 82222 and are subject to change without. Second mortgages come in two main forms home equity loans and home equity lines of credit. A shorter loan should be cheaper overall but the monthly repayments are likely to be higher than a standard 25-year mortgage so youll need to show you can comfortably afford to pay off the mortgage in a shorter time span.

However there are. While your credit score gives an indication of your borrowing history to lenders there are other factors that can affect their decision to accept you and how much theyre willing to lend. Second mortgage types Lump sum.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. 25 deposit - 152. COVID-19 borrowing authority for the United States Postal Service.

Bad credit mortgage. The interest rate you negotiate with your lender plus 2. Economy over the past couple of years it.

Use the Mortgage Qualifier Tool to see if you can qualify for a mortgage. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially granted. This Comparison Rate applies only to the example or examples given.

The interest rate is the amount of money the bank charges you for borrowing the money to pay for your home. Partners Providing you own 25 share or more of the limited liability partnership your share of average net profits over the last 2-3 years will be considered income for mortgage purposes. The borrowing amount is a guide only.

The principal of the. Getting pre-approved for. Take out a home equity line of credit.

A 400000 loan amount variable fixed principal and interest PI home loans with an LVR loan-to-value ratio of at least 80. Loan-to-Value Premium on Total Loan Premium on Increase to Loan Amount for Portability. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and.

Fixed rates from 799 APR to 2343 APR APR reflect the 025 autopay discount and a 025 direct deposit discount. Account for interest rates and break down payments in an easy to use amortization schedule.

3

10 High Paying Jobs That Don T Require A Degree High Paying Jobs Paying Jobs Tech Job

1

Mississauga Second Mortgage Brokers Lenders Serving All Of Ontario

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Loan Modification Specialist How Not To Get Ripped Off Real Estate Investment Group Home Equity Property Management

Mississauga Second Mortgage Brokers Lenders Serving All Of Ontario

3

Mortgage Employment Verification Form How To Create A Mortgage Employment Verification Form Download This Mort Templates Employment Mortgage Loan Originator

Fed S Senior Loan Officer Survey Reflects More Normal Economy

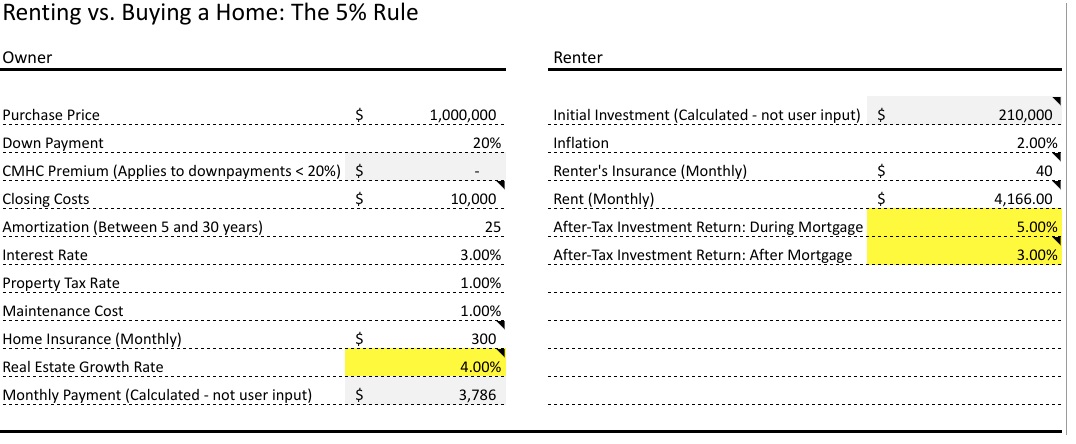

Rent Vs Buy Calculator The Devil S In The Details Toronto Realty Blog

Fed S Senior Loan Officer Survey Reflects More Normal Economy

Best Refinance Offers 25 Years Of Experience As Reliable Second Mortgage Broker In Mississauga

3

Tables To Calculate Loan Amortization Schedule Free Business Templates

Happy Birthday Realtor Card Set Real Estate Cards Realtor Cards Birthday Cards Realtor Popby S Realtor Cards Card Set Birthday Cards

Mortgage Mayhem By Marc Rubinstein Net Interest